|

Posted By Joe McClary, NBEA Executive Director,

Thursday, August 21, 2025

|

Don’t Train Your Students NOT to Participate

Ever ask your class a question and end up answering it yourself? Stop training your students NOT to participate! Learn how to embrace silence, boost engagement, and make crickets your secret teaching weapon. and make crickets your secret teaching weapon.

We’ve all been there. When I was a young educator and even later in life when I was facilitating adult training, I would ask questions in my workshops and toss out a brilliant question ;), full of energy and wisdom, and… crickets. The silence stretches, you feel awkward, your palms sweat, and before you know it—you blurt out the answer yourself. Congratulations—you’ve just trained your students not to participate.

When teachers jump in too soon, students learn an important (but unfortunate) lesson: “If I sit here long enough, my teacher will do the work for me.” And who can blame them? Free answers with zero effort? What a deal!

The Science of Awkward Silence

Here’s the thing: silence isn’t laziness—it’s thinking time. Research shows students need a pause to process, especially since what feels “obvious” to you may be brand-new for them. That dead air you dread? That’s actually the sound of learning in progress.

The Anti-Cricket Strategy

To break the cycle, try this simple process:

-

Ask the question. Clear, direct, no trickery.

-

Wait. Yes, really wait. Count in your head if you have to.

-

Get comfortable with silence. Awkwardness builds character.

-

Rephrase if needed. Same question, new angle.

-

Don’t cave and answer it yourself. Remember: you already know the answer!

-

Expect participation. Make it part of the classroom culture.

Warm Them Up

Still getting blank stares? Break the ice with easier, low-stakes questions first. Give students safe chances to speak before you dive into the tough stuff. Think of it as stretching before the mental workout.

Why It Matters

When students know you won’t rescue them from silence, they step up. Participation increases, discussions get better, and they start to realize learning is something they do, not something that happens to them.

So next time you’re tempted to answer your own question, resist. Let the silence hang. Trust the process. And remember: sometimes the best sound in your classroom is… nothing.

Because that “nothing” means your students are thinking.

Author

Joe McClary, CAE, Ed.S is the Executive Director of The National Business Education Association

Attached Thumbnails:

This post has not been tagged.

Permalink

| Comments (0)

|

|

Posted By Joe McClary CAE,

Friday, August 8, 2025

Updated: Friday, August 8, 2025

|

Each new school year is a fresh chapter. For business educators, it’s not just about teaching accounting, marketing, or entrepreneurship—it’s about shaping leaders  who will influence the world. History reminds us that our work matters, often in ways we never see at the time. who will influence the world. History reminds us that our work matters, often in ways we never see at the time.

1. Teach Like It Matters

Abraham Lincoln once said, “In the end, it’s not the years in your life that count. It’s the life in your years.” Each class period is an irreplaceable moment. Like the teacher who encouraged a young Warren Buffett to read financial news daily, your small acts may spark a lifelong passion.

2. Focus on One Student at a Time

Booker T. Washington’s mentor, General Samuel Armstrong, didn’t just see a student—he saw potential. Each week, identify one student who needs encouragement. You may not remember the words years from now, but they might.

3. Make It Real-World from Day One

In 1914, Henry Ford shocked the nation by paying workers $5 a day, connecting wages to loyalty and productivity. In the same way, connect your lessons to your students’ realities early on. An activity calculating the “cost of their dream life” can turn abstract concepts into eye-opening lessons.

4. Model Lifelong Learning and Resilience

Thomas Edison famously said, “I have not failed. I've just found 10,000 ways that won’t work.” When classroom technology glitches or a lesson falls flat, show students how professionals adapt. Your response to challenges will teach more than the challenge itself. One of the ways to do this is by attending the NBEA annual convention. There is no other organization that will provide the quality programming and relationship building like NBEA.

5. Lead with a Vision, Not Just a Plan

Madam C.J. Walker, America’s first self-made female millionaire, didn’t start with a perfect plan—she started with a vision to improve lives and stuck to it. Define your vision for your students this year, and let it guide every decision.

The Ripple Effect

History shows us that one teacher’s belief can echo across generations. Outstanding resilience in the classroom begins with being part of a community of educators that share challenges. The National Business Education Association (NBEA) is YOUR COMMUNITY. As you step into your classroom or lecture hall, remember: what you do this year will outlast the semester. Teach like it matters—because it does.

Attached Thumbnails:

Tags:

Fresh Start to the School Year

Permalink

| Comments (0)

|

|

Posted By Joe McClary CAE,

Wednesday, July 9, 2025

|

The National Business Education Association (NBEA) is proud to recognize and celebrate Alice Huskey, who recently surpassed her 54th consecutive year of NBEA membership. Alice began her journey with NBEA in 1972, and over five decades later, she continues to embody the values, professionalism, and passion that define the business education community. NBEA membership. Alice began her journey with NBEA in 1972, and over five decades later, she continues to embody the values, professionalism, and passion that define the business education community.

Originally from West Helena, Arkansas, Alice broke new ground as the first member of her family to attend college. With an early passion for business education, she never wavered from her dream. She earned both her Bachelor’s and Master’s degrees in Business Education from Arkansas State University in Jonesboro. Just one month after completing her Master’s, she began teaching at Motlow State Community College in Lynchburg, Tennessee—a newly established college located in the scenic hills of middle Tennessee.

At that time, Motlow was a young institution with just one campus. Today, it has grown into a thriving college with multiple campuses and sites. Alice’s teaching career at Motlow spanned nearly 40 years—35 years full-time and another four years part-time. Her impact continued even after retirement, as she remained an academic advisor part-time until her third and final retirement, culminating in a remarkable 48-year service to the institution.

Alice’s dedication to teaching was matched by her embrace of technology and innovation. She witnessed and led the transformation from electric IBM typewriters to the dawn of online instruction. At Motlow, she played a vital role in training faculty and staff in the emerging world of computer technology, word processing, and digital procedures. Beyond traditional credit courses, she also taught non-credit classes, CPS Review sessions, and contract training for local businesses.

Alice’s NBEA story began in her third year of teaching when a colleague encouraged her to join. What started as a resource for teaching ideas and liability insurance quickly blossomed into a deep professional commitment. Her involvement grew to include leadership roles in TBEA, SBEA, and NBEA, where she served on executive boards, chaired committees, and took on roles such as session coordinator and convention presenter.

For more than 18 years, Alice served as Tennessee Membership Director for all three organizations. Her contributions were recognized with numerous awards throughout her career, but she considers her proudest honor to be the 2002 NBEA Postsecondary Teacher of the Year Award.

Alice credits NBEA with connecting her to a network of professional peers and lifelong friends. Among her many treasured experiences, she highlights the mentorship of former NBEA Executive Director Dr. Jan Treichel as especially meaningful.

“I can’t say enough about what NBEA has meant to me all these years,” Alice shared. “I challenge each of you to get involved, stay involved, solicit more members, and you won’t be disappointed. As they say, ‘what you get from anything depends on what you put into it’—that’s certainly true in the classroom as well as in life.”

Alice Huskey’s legacy is a shining example of commitment, growth, and impact in business education. We thank her for 54 years of loyalty and leadership, and we honor her continued presence in the NBEA community.

Attached Thumbnails:

This post has not been tagged.

Permalink

| Comments (4)

|

|

Posted By Joe McClary CAE,

Wednesday, May 21, 2025

|

I was recently scanning news articles about business education and examined a recent Fast Company magazine article titled “Why Business Schools Are Failing Society.” The article paints a dramatic picture of higher education as outdated and complicit in societal dysfunction.

While the author, a respected academic, raises valid concerns about capitalism and sustainability, the article overstates the influence of business schools and unfairly blames them for systemic problems that span government, policy, and culture. At the National Business Education Association (NBEA), we believe it’s important to offer a more grounded and accurate view—one that reflects the tremendous strides educators are making across the country.

Here are five key ways business education is advancing society—not failing it.

1. Shareholder capitalism isn’t broken—it’s evolving.

The article argues that shareholder capitalism is “broken,” but that claim oversimplifies a complex and historically successful economic framework. While no system is without flaws, market-based capitalism—particularly in its shareholder form—has lifted more people out of poverty, increased life expectancy, and driven innovation on a global scale. The flexibility of capitalism lies in its ability to adapt to new realities and incorporate values beyond profit, such as sustainability and long-term value creation. Rather than being broken, shareholder capitalism is being refined—and business schools are central to guiding that evolution. Educators are helping future leaders understand how to balance profit with purpose and make decisions that benefit shareholders and society.

2. Business schools are catalysts for innovation and ethics—not defenders of the status quo.

Modern business curricula have undergone significant transformation. Subjects such as corporate social responsibility, sustainable business models, and ethical leadership are now core components—not just fringe electives. Educators are encouraging students to wrestle with real-world challenges like environmental stewardship, long-term strategy, and the ethical use of technology. These are not institutions clinging to outdated models; they are actively shaping the next generation of leaders to think critically and responsibly.

3. Business education emphasizes stewardship, not selfishness.

The claim that business schools teach students to pursue only profit is a mischaracterization. Today’s programs help students understand the broader purpose of business: to create value, serve customers, and contribute to healthy economies. Many schools now teach stakeholder theory alongside traditional shareholder models, prompting students to think holistically about the impact of their decisions. Educators regularly challenge students to consider the “why” behind business—not just the “how.”

4. Systemic issues like climate change and inequality require cross-sector solutions.

While business has an essential role in addressing climate risk and economic disparity, these are society-wide challenges that involve government policy, global trade dynamics, and cultural change. Blaming business education for systemic breakdowns ignores the progress being made within institutions—and the role of other sectors in enabling or constraining reform. Business schools are often incubators for solutions, not barriers to them.

5. Today’s students want more than high salaries—they want meaningful careers.

Students entering business education today are not driven solely by financial ambition. Many are passionate about entrepreneurship, sustainability, and creating positive change through commerce. Schools are responding with programs in social entrepreneurship, impact investing, and innovation ecosystems. Students are not passive recipients of outdated models; they are active voices pushing institutions to be more responsive, human-centered, and future-focused.

Conclusion

Rather than condemning business schools, we should recognize them as key players in the evolution of modern society. Far from failing, business educators at all levels—from high school to graduate school—are helping students think critically, act ethically, and lead with purpose. The very capitalistic system the author criticizes is the very system making business education better. The real opportunity is not to tear down business education, but to invest in it, support its continued adaptation, and acknowledge the progress it is making every day.

Joe McClary, is the Executive Director of the National Business Education Association

The views expressed herein do not represent an official position of the NBEA Board of Directors and all commentary are the author's and authors alone.

This post has not been tagged.

Permalink

| Comments (0)

|

|

Posted By NBEA,

Monday, April 21, 2025

|

High school marketing education is evolving rapidly, reflecting shifts in technology, business needs, and student expectations. Below are key trends shaping today’s marketing curriculum.

1. Digital-First and Technology Integration

A major trend is the move toward digital-centric marketing education. Modern curricula increasingly emphasize digital marketing tools, online advertising, and social media strategies. Programs like the M-School initiative place digital marketing at the core, ensuring students gain hands-on experience with current industry practices. This shift is driven by the need to prepare students for a marketplace where digital skills are essential[1].

2. Experiential and Project-Based Learning

Marketing courses now prioritize experiential learning and project-based activities. Students often work with real businesses or school stores, developing marketing plans, conducting market research, and executing promotional campaigns. These experiences foster practical skills, critical thinking, and teamwork, making learning more relevant and engaging[2][1].

3. Comprehensive Coverage of Marketing Concepts

Courses continue to cover foundational marketing principles—market research, sales, product development, pricing, and promotion—while expanding into areas like entrepreneurship and career development. Role-playing exercises, such as mock interviews or business scenarios, are commonly used to build communication and problem-solving skills[3][4].

4. Emphasis on Career Readiness and Leadership

Programs are designed to help students explore marketing career paths and develop professional skills. Co-curricular organizations like DECA and FBLA play a significant role, offering competitions, scholarships, and leadership opportunities. These activities help students apply classroom knowledge in real-world contexts and build resumes for future employment or college applications[3][5][4].

5. Focus on Ethics and Critical Thinking

Modern marketing curricula integrate discussions on ethics, responsible advertising, and the impact of marketing on society. Students are challenged with ethical dilemmas and encouraged to make informed, responsible decisions—skills highly valued in today’s business environment[5].

6. Collaboration with Industry Partners

To keep content current and relevant, many programs collaborate with local businesses and industry professionals. This partnership approach ensures students are exposed to up-to-date practices and can network with potential mentors or employers[1].

Summary Table: Key Trends in High School Marketing Education

|

Trend

|

Description

|

|

Digital-First Curriculum

|

Focus on digital marketing, social media, and online tools

|

|

Experiential/Project-Based Learning

|

Real-world projects and hands-on activities

|

|

Comprehensive Marketing Principles

|

Coverage of core concepts plus entrepreneurship and career skills

|

|

Career Readiness & Leadership

|

DECA/FBLA involvement, resume-building, leadership development

|

|

Ethics & Critical Thinking

|

Emphasis on responsible, ethical decision-making

|

|

Industry Collaboration

|

Partnerships with businesses for up-to-date, relevant learning

|

Business teachers are encouraged to adapt their courses to these trends, ensuring students are both industry-ready and capable of navigating the dynamic world of modern marketing[3][5][2][1][4].⁂

- https://digitalcommons.lmu.edu/cgi/viewcontent.cgi?article=1011&context=mbl_fac

- https://hs.hassk12.org/apps/pages/index.jsp?uREC_ID=2638227&type=d&pREC_ID=2286268

- https://boe.parkhill.k12.mo.us/attachments/8afeda36-2bed-410d-84a5-f2d18d3e8065.pdf

- https://resources.finalsite.net/images/v1623862541/parkhillk12mous/eh8kbiyzzwaz5uae57cw/MarketingConceptsCourseSummary--BoardApprovedJune222017.pdf

- https://www.education.ky.gov/CTE/ctepa/Documents/24-25_BusandMark-Courses.pdf

Note: portions of this article were checked by Perplexity.ai and also reviewed for accuracy by business educators.

This post has not been tagged.

Permalink

| Comments (0)

|

|

Posted By Sid C. Bundy,

Friday, February 21, 2025

|

Abstract: High school business educators are crucial in preparing students for future careers, but accounting—a key field—often receives limited attention in the curriculum. The 2023 National Pipeline Advisory Group (NPAG) report highlights a significant decline in students pursuing accounting degrees and sitting for the CPA exam. To address this, it’s essential to engage students with accounting concepts earlier in their education. This article explores ways to enhance the Introduction to Business and Marketing course by incorporating practical, real-world accounting applications and partnering with CPAs. By integrating case studies, interactive accounting software, and CPA guest speakers into lessons, teachers can offer students a more comprehensive understanding of accounting’s role in business and finance. Currently, fewer than 1.5% of U.S. high school students are enrolled in an accounting course, revealing a critical gap in the profession’s pipeline. Strengthening high school accounting education and collaboration with CPAs can help inspire students to consider accounting as a career path, addressing the profession’s growing workforce challenges.

Keywords: Accounting education, CPA engagement, high school curriculum, business teachers, career pipeline, workforce development

___________________________________________

High school business educators play an essential role in shaping the future workforce by providing students with foundational knowledge of business principles. One of the key opportunities within the Introduction to Business and Marketing course is exposing students to the world of accounting—a field that is crucial but often misunderstood by students. With a nationwide shortage of qualified accountants, as highlighted by the National Pipeline Advisory Group (NPAG) report, there is an urgent need to offer students more comprehensive early engagement with accounting (AICPA, 2023).

The NPAG report stresses that fewer students are pursuing accounting degrees or sitting for the CPA exam. To address this gap, it is important to engage students at an earlier stage in their education (AICPA, 2023). High school courses like Introduction to Business and Marketing provide an ideal entry point for introducing students to accounting concepts, laying the groundwork for future career choices.

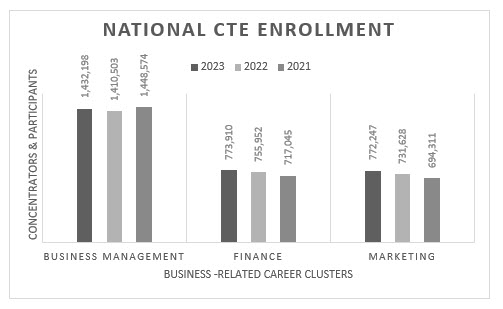

Introduction to CTE Career Cluster Enrollment

The data in Figure 1 illustrates the national enrollment of students in business-related Career and Technical Education (CTE) clusters, specifically highlighting the Business Management, Finance, and Marketing clusters from 2021 to 2023. It is important to note that these numbers reflect both concentrators and participants, as classified in the Perkins data.

A participant is defined as a student who has completed at least one course in a CTE program area, while a concentrator is a student who has completed a defined sequence of courses or achieved a specific level of credit in the program, indicating deeper involvement. These classifications can sometimes lead to overlapping numbers, as students may concentrate or participate in more than one CTE cluster, which may result in potential double-counting in the data. Despite this, the enrollment numbers provide valuable insights into the scale and reach of business-related education within the CTE system.

Discussion of the Data

All three of these career clusters require students to complete the Introduction to Business and Marketing course as participants during their foundational training. This course serves as an essential gateway for students as they explore business-related careers, including accounting, which falls within the Finance Career Cluster. Given the consistent enrollment across these clusters, the Introduction to Business and Marketing course plays a crucial role in shaping students' early understanding of business principles and career pathways.

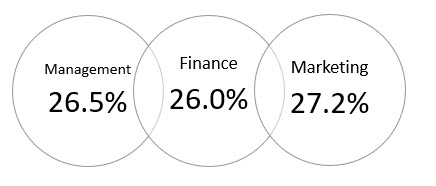

Introduction to Student Concentration in Business-Related Career Clusters

In Figure 2, the data illustrates the proportion of students in the Business Management, Finance, and Marketing clusters who are classified as concentrators in 2023. A concentrator refers to a student who has completed a defined sequence of courses, meaning they have progressed beyond the introductory level in their CTE pathway. The remainder of the students, nearly 75%, are classified as participants, which means they have only completed the initial course, Introduction to Business and Marketing.

Proportion of Enrolled Students Classified as Concentrators

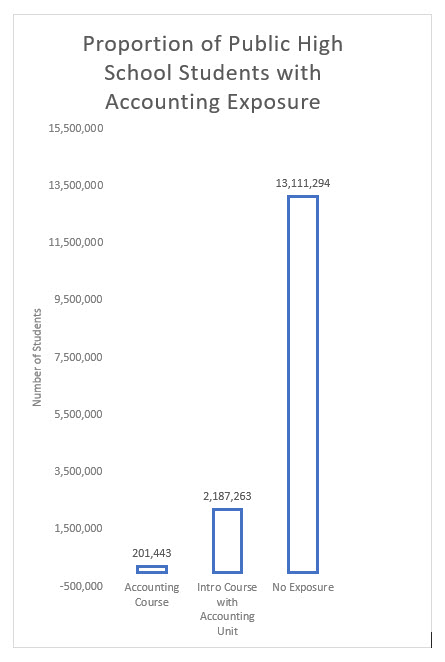

In 2023, slightly more than one-quarter of students in these clusters were classified as concentrators. Specifically, there were 201,443 concentrators in the career fields that fall under the Finance cluster, which includes accounting. This means that across the entire nation, only 201,443 students were likely enrolled in an accounting course in that year.

To put this into perspective, the total number of public high school students in the United States is close to 50 million. This figure highlights a critical gap in the pipeline for future accountants and other finance professionals, underscoring the importance of ensuring that more students move beyond the introductory courses and into advanced coursework in these fields.

Figure 3 demonstrates that in 2023 only 1.3% (201,443 students) of the total 15.5 million public high school students in the U.S. were likely enrolled in an accounting course. Due to duplicate reporting between career clusters, the data doesn’t reveal the total enrollment in the Introduction to Business and Marketing course; however, between 2.9% (1,052,666 business management participants) and 14.1% (2,187,263 total participants across three business-related clusters) were likely enrolled in Introduction to Business and Marketing in 2023. This portion of students represents those who are receiving at least some exposure to business-related subjects, but it’s important to emphasize that even within this course, students generally receive only a brief introduction to accounting, often limited to a single unit. The remaining 83% of high school students had little to no exposure to the foundational principles of accounting, contributing to the ongoing challenges in the accounting pipeline.

Partnering with CPAs, who bring real-world experience and insights, offers a way to strengthen the accounting unit within this course and ensure students receive a well-rounded understanding of the profession.

The NPAG Report: Engaging Students Earlier

The NPAG report reveals that between 2019 and 2023, the accounting profession experienced a 17.3% reduction in its workforce, while the working-age population grew by just 3% (AICPA, 2023). Additionally, fewer students are enrolling in accounting programs and taking the CPA exam. This shrinking pipeline is a key concern for the future of the profession.

The report underscores the importance of engaging students at an earlier stage in their academic journey. Most high school students are not fully aware of the range of opportunities within accounting, and they may have a limited understanding of what accountants do. Enhancing the accounting curriculum in high school business courses offers a valuable opportunity to fill this gap.

Enhancing the Current Curriculum

The Introduction to Business and Marketing course provides a foundational overview of various business concepts, including accounting. However, there is potential to expand this unit to better engage students and provide more practical, real-world applications of accounting concepts. The following table outlines key areas for curriculum enhancement and suggests ways to incorporate CPA expertise to deepen student understanding.

|

Current Curriculum

|

Suggested Improvement

|

CPA Engagement and Targeted Exposure

|

|

Foundational Financial Concepts

|

Shift focus to introduce financial statements and using data over its preparation. Emphasize the dynamic role of accountants in solving real-world problems, emphasizing the societal impact of ethics, sustainability, and fraud prevention. Incorporate industries like sports, entertainment, and tech into lessons.

|

CPAs can share case studies from diverse fields—such as environmental accounting, forensic accounting, or technology startups—where financial decision-making and reporting have a significant impact (AICPA, n.d.).

|

|

Differentiating Fixed and Variable Expenses

|

Make cost analysis more relevant by highlighting exciting industries such as eSports, fashion, or sustainable energy. Showcase how accountants advise companies on cost-saving strategies and profitability analysis.

|

CPAs can bring real-life examples of how their firms help businesses become more profitable by optimizing fixed and variable expenses. Examples from cutting-edge fields will make accounting seem more impactful and innovative.

|

|

Preparing Mock Financial Documents

|

Add an element of excitement by incorporating forensic accounting challenges or investigating high-profile fraud cases. Create scenarios where students "uncover" financial discrepancies and present their findings.

|

CPAs can introduce students to the field of forensic accounting, including stories of major fraud investigations and how accountants play a critical role in uncovering and preventing financial crimes (Perkins Collaborative Resource Network, 2023).

|

|

Budget Planning for a CTSO Event or Project

|

Introduce the idea of accountants as strategic planners in areas like disaster recovery, sustainability, or global business expansion. Students could work on budgets for simulated crises or international operations.

|

CPAs can mentor students in strategic financial planning exercises, such as forecasting the budget for a tech startup or an international expansion, showing how accountants are key players in making businesses resilient and future-ready (AICPA, 2023).

|

Building Stronger Partnerships Between Educators and CPAs

High school business educators have deep expertise in teaching broad business principles, and CPAs bring complementary skills that can enhance students' learning experiences. By working together, business teachers and CPAs can provide students with a fuller understanding of the role accounting plays in various industries and personal finance.

Collaboration between educators and CPAs could involve sharing case studies, developing interactive lessons, and offering guest lectures. CPAs can offer valuable insights into real-world applications of accounting, helping students connect what they learn in the classroom to viable career paths.

National Programs and Resources

Several national programs support educators in introducing students to the accounting profession in an engaging way. For example, the AICPA’s Start Here, Go Places program offers interactive tools and resources designed to introduce students to accounting careers (AICPA, n.d.). The Accounting Pilot & Bridge Project (APBP) also helps teachers deepen their students' exposure to accounting by offering advanced training and materials for high school educators.

Incorporating resources like these into high school business courses aligns with the NPAG report’s recommendation to expose students to accounting earlier. This approach ensures students receive a comprehensive introduction to accounting and its various career opportunities.

Conclusion

High school business courses offer an invaluable opportunity to introduce students to the accounting profession. By enhancing the accounting unit in the Introduction to Business and Marketing course and partnering with CPAs, students can gain a clearer understanding of the field and its relevance to business and finance.

Through curriculum improvements and increased collaboration with accounting professionals, students will be better equipped to pursue accounting as a career, helping to build a stronger, more sustainable pipeline of future accountants. This partnership between educators and CPAs will not only address the profession's current workforce challenges but will also inspire students to explore the diverse opportunities that accounting offers.

References

AICPA. (n.d.). Start Here, Go Places. Retrieved from https://www.startheregoplaces.com

AICPA. (2023). National Pipeline Advisory Group (NPAG) report. American Institute of Certified Public Accountants.

Career and Technical Education (CTE) System. (n.d.). Introduction to Business and Marketing course curriculum. Retrieved from https://www.cte.gov

National Business Education Association (NBEA). (n.d.). NBEA annual meeting. Retrieved from https://www.nbea.org

National Center for Education Statistics. (2023). Public school enrollment. Retrieved from https://nces.ed.gov/programs/digest/d21/tables/dt21_203.10.asp

Perkins Collaborative Resource Network. (2023). Perkins V: Strengthening career and technical education for the 21st century act. U.S. Department of Education. Retrieved from https://cte.ed.gov

Attached Thumbnails:

This post has not been tagged.

Permalink

| Comments (0)

|

|

Posted By Joe McClary CAE,

Thursday, February 20, 2025

|

By Joe McClary, NBEA Executive Director

Over the past year, I have had the privilege of volunteering as a judge for DECA student competitions. These competitions provide high school students with real-world business experience as they present entrepreneurial pitches, hoping to convince judges—acting as potential investors—to fund their fictitious ventures. Some students impress with well-researched, creative presentations, while others gain valuable experience in the art of the pitch.

But after judging several of these competitions, I’ve noticed a common and concerning trend: Almost every student pitch includes a marketing strategy heavily reliant on radio and TV advertising.

The Problem with Outdated Advertising Strategies

Traditional media—TV and radio—has its place in marketing, but it’s also among the most expensive advertising methods available. Many of these students don’t fully understand the cost implications of running even a small-scale TV or radio campaign. A local radio ad can cost anywhere from $200 to $5,000 per week, while a 30-second television spot in a mid-sized market can cost tens of thousands of dollars—and that’s not even counting production costs. For a small startup with a limited budget, these options are often unrealistic.

So why are students defaulting to these strategies? The answer is simple: They don’t have enough exposure to modern digital marketing.

The Missed Opportunity in Digital Marketing

While students may be active on social media platforms personally, they often lack knowledge about how to leverage digital marketing effectively for business purposes. Strategies like:

- Social Media Marketing – Using platforms like Instagram, TikTok, and LinkedIn for targeted brand engagement.

- Pay-Per-Click (PPC) Advertising – Running cost-effective, trackable ads on Google and Facebook.

- Influencer Marketing – Partnering with micro-influencers to tap into niche audiences.

- SEO and Content Marketing – Creating blogs, videos, and other online content that attract organic traffic.

- Email Marketing – A low-cost, high-ROI method of keeping potential customers engaged.

These digital approaches are often cheaper, more targeted, and provide measurable results, making them a much better fit for small businesses.

How We Can Better Prepare Students

To bridge this gap, we need to ensure students have hands-on experience with digital marketing tools before they graduate. Here’s how business educators and programs like DECA can help:

-

Integrate Digital Marketing Projects into Curriculum

- Have students create and manage social media accounts for fictitious businesses.

- Teach Google Ads and Meta Ads basics, including budgeting and audience targeting.

- Assign real-world case studies on viral marketing and influencer partnerships.

-

Encourage Partnerships with Local Businesses

- Students could run small social media campaigns for local startups, giving them real-world experience while benefiting the business.

-

Introduce Free Digital Marketing Certifications

- Programs like Google Digital Garage, HubSpot Academy, and Facebook Blueprint offer free certifications that students can add to their resumes.

-

Host Digital Marketing Competitions

- Instead of just pitching business ideas, students could compete in running the most effective digital marketing campaign for a hypothetical product.

Preparing for the Future of Business

The marketing landscape has shifted dramatically over the past two decades. While traditional advertising methods still have their place, digital strategies dominate modern marketing efforts. It’s time we ensure our students are learning the skills they need to succeed in this evolving world.

By equipping students with real digital marketing experience, we’re not just improving their DECA pitches—we’re preparing them for a future where they can launch and grow real businesses in the digital age.

This post has not been tagged.

Permalink

| Comments (0)

|

|

Posted By Joe McClary CAE,

Monday, October 21, 2024

|

In recent years, there's been a growing recognition of the importance of personal finance education in high schools across the United States. As the economic landscape becomes increasingly complex, states are adopting new graduation requirements aimed at equipping young Americans with essential financial skills. According to the Council for Economic Education, as of 2024, over 35 states have mandated personal finance coursework as a high school graduation requirement, with more expected to follow. But as these policies surge in popularity, one critical question arises: Will they make a real difference in the lives of Americans? landscape becomes increasingly complex, states are adopting new graduation requirements aimed at equipping young Americans with essential financial skills. According to the Council for Economic Education, as of 2024, over 35 states have mandated personal finance coursework as a high school graduation requirement, with more expected to follow. But as these policies surge in popularity, one critical question arises: Will they make a real difference in the lives of Americans?

The Need for Financial Literacy

The case for requiring personal finance education in high schools is compelling. As the cost of living rises and financial products become more intricate, many Americans struggle with basic money management. According to the National Financial Educators Council, a lack of financial knowledge costs Americans an average of $1,819 per person per year. Furthermore, data from the Federal Reserve shows that nearly 40% of U.S. adults would struggle to cover an unexpected $400 expense. Clearly, the need for financial literacy is more pressing than ever.

High school, with its captive audience of young minds preparing to enter adulthood, seems like an ideal setting to teach essential financial concepts. Courses covering topics like budgeting, investing, credit management, and student loans offer students the tools they need to navigate an increasingly complex financial world. The hope is that by providing this foundational knowledge early, students will avoid common financial pitfalls and be better equipped to build stable, prosperous lives.

Challenges on the Horizon

However, while these graduation requirements are a step in the right direction, there are some hurdles to overcome to ensure they translate into meaningful, long-term financial empowerment.

First, one-size-fits-all curricula may not work for every student. High schoolers come from diverse socioeconomic backgrounds, meaning some may already be exposed to financial conversations at home, while others might have no experience with budgeting or banking. Creating coursework that is engaging and relevant to students from all walks of life is essential, but it’s no small feat.

Second, teacher preparedness is a significant factor. As more states implement these financial education requirements, the burden falls on teachers to deliver high-quality instruction. Many business or social studies teachers may be tasked with teaching financial literacy, despite not having specialized training in the subject. If educators themselves aren't well-versed in personal finance, it could limit the effectiveness of the instruction. Professional development for teachers in personal finance is crucial to ensuring they feel confident and capable of delivering the material in an impactful way.

Finally, retention and application of the knowledge students gain are key issues. Teaching financial literacy isn't just about helping students pass a course—it's about fostering long-term behavioral changes. Will students remember and apply what they learn when they're making major financial decisions years later, such as taking out loans or managing their first paychecks? Without real-world application or continued reinforcement of the lessons taught, there's a risk that the knowledge won't translate into action.

The Teacher's Role in Making a Difference

Despite these challenges, there is immense potential for financial education requirements to truly change lives—and teachers are the linchpin in this equation. When equipped with the right tools and knowledge, teachers can ensure that personal finance education makes a lasting impact on students' futures.

Engagement is key. Teachers can bring personal finance to life by connecting abstract concepts to students' real-world experiences. For example, simulating budget planning for a first apartment or exploring the consequences of poor credit can help students see the relevance of the material. Teachers who make financial literacy interactive, relatable, and engaging are more likely to inspire students to take the subject seriously.

Creating a safe space for questions is another crucial element. Financial literacy often touches on topics students may feel uncomfortable discussing, like family finances, debt, or socioeconomic status. Teachers can create a supportive environment where students feel comfortable asking questions, even if those questions seem basic. Encouraging open dialogue helps break down barriers and promotes a deeper understanding of financial concepts.

Beyond the curriculum, fostering financial habits is just as important as delivering the content. Teachers can encourage students to practice financial decision-making through simulations or project-based learning. Whether it’s managing a mock stock portfolio, creating a personal budget, or developing a plan to save for college, these practical exercises give students a taste of real-world financial decisions, reinforcing their knowledge through application.

Finally, teachers have the power to instill a growth mindset around financial literacy. While not every student will leave high school with a perfect understanding of complex financial products, teachers can plant the seeds of curiosity and confidence. When students believe they can continually learn and improve their financial skills, they’re more likely to seek out information and make informed decisions throughout their lives.

The Long-Term Promise of Financial Education

As financial education becomes more prevalent in high schools, it has the potential to transform the way future generations approach money. While challenges remain, the role of teachers in bridging the gap between knowledge and practical application cannot be understated. By engaging students, fostering curiosity, and making the subject relevant, teachers can ensure that the surging financial education requirements truly make a difference in the lives of young Americans. If successful, these initiatives could help reverse the tide of financial insecurity, empowering individuals to make smarter, more informed decisions and ultimately build a more financially stable society.

With the right approach, financial education has the potential to not just prepare students for graduation but for a lifetime of financial well-being.

-----------

Joe McClary, CAE is the Executive Director at the National Business Education Association. He can be reached at ExecutiveDirector@nbea.org

Attached Thumbnails:

This post has not been tagged.

Permalink

| Comments (1)

|

|

Posted By Joe McClary CAE,

Thursday, October 3, 2024

|

75 percent of NBEA members recently polled believe the number of business educators is decreasing across the United States. This is an understandable belief because of the massive shift in "business education" topics over the past two decades. However, how can we measure the number of business educators certifiying to teach?

NBEA was challenged with this question and reached out to the Educational Testing Service (ETS). ETS adminsters the Praxis 5101 exam which is is a subject-specific exam that tests knowledge of business-related topics. Many states use the 5101 in their traditional and non-traditional certification programs to evaluate the qualifications of prospective teachers. The Praxis tests are used in 46 states and the District of Columbia.However, each state has its own Praxis testing requirements, and some states only require the Praxis for specific areas or none at all.

The hypothesis is that if we measure the number of Praxis 5101 tests taken over time, it should give us a general benchmark to determine whether the number of teachers qualifying is increasing or decreasing.

Examining data back to 2015, this is what we find:

Note: ETS reports data every three years and doesn't break down the years separately.

| August 2015-July 2018: Approximately 1,601 test takers per year |

| August 2016-July 2019: Approximately 1,540 test takers per year |

| August 2017-July 2020: Approximately 1,544 test takers per year |

| August 2018-July 2021: Approximately 1,451 test takers per year |

| August 2020-July 2023: Approximately 1,537 test takers per year |

A statistical analysis shows a standard devision across years of only 53.67 test takers. So what do we take from this when combined with the antidotal information from teachers in the field?

1. These results indicate national trends, not local.

2. There is evidence that the number of business teachers qualifying is consistent across years.

3. These results are for secondary school not college or university which have different teacher qualifying criteria.

4. Antidotal reports to NBEA indicate a SHIFTING in business education topics. For example, traditional "business teachers" may be shifting to computer related courses.

Thoughts? Do you see problems with this hypothesis? do you have a better idea of how NBEA could better measure the number of business educators? Leave a comment.

This post has not been tagged.

Permalink

| Comments (1)

|

|

Posted By NBEA,

Friday, September 20, 2024

|

As more professionals transition from industry to education through alternative certification programs, high school business educators are increasingly finding their way into classrooms via non-traditional pathways. While these educators often bring valuable real-world business experience, their journey into teaching can look quite different from that of their peers who pursued formal, university-based teacher preparation programs. In this article, we explore the top five differences between non-traditionally certified educators and those with traditional certification, along with insights into how to address potential gaps and succeed in the classroom. their way into classrooms via non-traditional pathways. While these educators often bring valuable real-world business experience, their journey into teaching can look quite different from that of their peers who pursued formal, university-based teacher preparation programs. In this article, we explore the top five differences between non-traditionally certified educators and those with traditional certification, along with insights into how to address potential gaps and succeed in the classroom.

1. Classroom Management Training

One of the most significant differences between non-traditional and traditional certification routes is the depth of training in classroom management. University-based programs typically devote extensive time to teaching prospective educators how to manage diverse student behaviors, foster engagement, and create a positive learning environment. In contrast, non-traditional certification programs often emphasize content mastery and provide less comprehensive training in classroom management techniques (Feiman-Nemser, 2001).

For non-traditionally certified educators, proactively seeking professional development or mentorship in this area is essential. Understanding how to maintain discipline while creating a supportive atmosphere will significantly impact the effectiveness of your teaching.

2. Focus on Pedagogy and Learning Theories

Traditional certification programs offer a deep dive into pedagogical theories and how students learn (Darling-Hammond & Bransford, 2005). These programs equip educators with an understanding of developmental psychology, differentiated instruction, and various teaching methodologies. However, alternative certification programs often skip over this foundational knowledge, assuming that educators will pick it up on the job (Feiman-Nemser, 2001).

If you’ve entered teaching through a non-traditional pathway, it’s worth investing time in learning about educational psychology and instructional strategies. Professional organizations like the National Business Education Association (NBEA) offer resources and workshops that can help bridge these gaps, enabling you to design lessons that meet diverse student needs.

3. Limited Student Teaching Experience

A hallmark of university-based teacher preparation is the immersive student teaching experience. Traditionally certified educators spend a significant amount of time in the classroom under the supervision of experienced mentors before taking on their own classes (Feiman-Nemser, 2001). In contrast, many non-traditional programs offer a more limited, fast-tracked teaching practicum or may place educators directly into classrooms without extended student teaching.

If your alternative certification program provided limited in-classroom experience, it can be helpful to seek out opportunities to observe seasoned educators or collaborate with colleagues to refine your classroom skills. Building a network of support will help you feel more confident and prepared to navigate real-time challenges.

4. Emphasis on Content Knowledge Over Pedagogy

Non-traditionally certified educators, particularly those entering from the business world, often have strong content expertise in their subject area. While this is a tremendous asset, traditional programs place equal emphasis on pedagogy—the art and science of teaching (Darling-Hammond & Bransford, 2005). Without this balance, new educators may struggle to translate their knowledge into effective teaching practices that resonate with high school students.

To address this, focus on enhancing your pedagogical skills by participating in teaching workshops or engaging with experienced peers who can share best practices. Understanding how to make complex business concepts accessible to students is key to your success in the classroom.

5. Assessment and Evaluation Techniques

Traditional teacher preparation programs include thorough training on assessment strategies, teaching educators how to measure student learning, provide constructive feedback, and adjust instruction accordingly (Darling-Hammond & Bransford, 2005). In non-traditional certification programs, the focus is often more on subject matter expertise, and less time is spent on learning diverse methods of assessment (Feiman-Nemser, 2001).

To close this gap, familiarize yourself with formative and summative assessment techniques. Assessments should go beyond tests and quizzes to include projects, discussions, and other methods that encourage critical thinking. Continuous learning in this area will enable you to track student progress more effectively and ensure that your teaching is aligned with learning goals.

Conclusion

For high school business educators who have become certified through non-traditional or alternative means, understanding these top five differences is key to a successful teaching career. While you bring invaluable industry knowledge to the classroom, addressing potential gaps in classroom management, pedagogy, hands-on teaching experience, and assessment will ensure you can translate that knowledge into meaningful learning experiences for students. By engaging in ongoing professional development and seeking mentorship, you can effectively bridge these gaps and thrive in your new role as an educator.

References:

1. Feiman-Nemser, S. (2001). From Preparation to Practice: Designing a Continuum to Strengthen and Sustain Teaching. Teachers College Record, 103(6), 1013-1055.

2. Darling-Hammond, L., & Bransford, J. (Eds.). (2005). Preparing Teachers for a Changing World: What Teachers Should Learn and Be Able to Do. San Francisco: Jossey-Bass.

Attached Thumbnails:

This post has not been tagged.

Permalink

| Comments (0)

|

|

Immediate Past President

Immediate Past President 2025-2026 President

2025-2026 President President-elect

President-elect